Content

If you have shareholders, dividends paid is the amount that you pay them. Cash dividends reduce the amount of the company’s cash account, and as such reduce asset value of the company’s balance sheet. Stock payments are not cash items and therefore do not affect cash outflow but do reallocate the portion of retained earnings statement of retained earnings formula to common stock and additional paid-in capital accounts. These statements explain the changes of the company’s equity throughout the reporting period. They break down changes in the owners’ interest in the organization, and in the application of retained profit or surplus from one accounting period to the next.

If a company has consistently incurred substantial losses at the “bottom line,” its retained earnings balance could eventually become negative, which is recorded as an “accumulated deficit” on the books. Calculating retained earnings after a stock dividend involves a few extra steps to figure out the actual amount of dividends you’ll be distributing. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. The income money can be distributed among the business owners in the form of dividends. Retained earnings is the amount of net income left over for the business after it has paid out dividends to its shareholders. He example statement of retained earnings in Exhibit 1 belongs to the same set of related company reporting statements appearing throughout this encyclopedia. The complete set also includes examples of the Income Statement, Balance Sheet, and Statement of Changes in Financial Position .

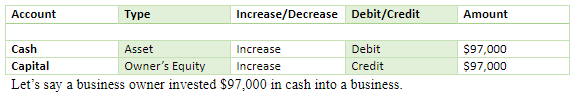

For example, you could tell investors that you’ll pay out 40 percent of the year’s earnings as dividends or that you’ll increase the amount of dividends each year as long as the company keeps growing. Owners’ equity or shareholders’ equity is what’s left after you subtract all the liabilities from the assets.

What Is The Statement Of Retained Earnings?

The only difference is that accounts receivable and accounts payable balances would not be factored into the formula, since neither are used in cash accounting. Retained earnings can be used to pay additional dividends, finance business growth, invest in a new product line, or even pay back a loan. Most companies with a healthy retained earnings balance will try to strike the right combination of making shareholders happy while also financing business growth.

Booz Allen Hamilton Holding’s (NYSE:BAH) earnings growth rate lags the 19% CAGR delivered to shareholders – Nasdaq

Booz Allen Hamilton Holding’s (NYSE:BAH) earnings growth rate lags the 19% CAGR delivered to shareholders.

Posted: Wed, 01 Dec 2021 15:37:59 GMT [source]

Retained earnings is a permanent account that appears on a business’s balance sheet under the Stockholder’s Equity heading. The account balance represents the company’s cumulative earnings since formation that have not been distributed to shareholders in the form of dividends. Next period, if you make $450,000 in retained earnings, you’ll have $910,000 total. In other words, since forming your company, you’ve made enough to “keep” $910,000 for the company after wages, operating expenses, dividends paid to stockholders, etc. The retained earnings account on the balance sheet is said to represent an “accumulation of earnings” since net profits and losses are added / subtracted from the account from period to period. This statement of retained earnings appears as a separate statement or it can also be included on the balance sheet or an income statement.

Why Are Retained Earnings Important?

Although this statement is not included in the four main general-purpose financial statements, it is considered important to outside users for evaluating changes in the RE account. This statement is often used to prepare before the statement of stockholder’s equity because retained earnings is needed for the overall ending equity calculation. Your retained earnings can be useful in a variety of ways such as when estimating financial projections or creating a yearly budget for your business.

Retained Earnings Definition – Accounting – Investopedia

Retained Earnings Definition – Accounting.

Posted: Sun, 26 Mar 2017 00:27:15 GMT [source]

For our retained earnings modeling exercise, the following assumptions will be used for our hypothetical company as of the last twelve months , or Year 0. In other words, cash from operations is sufficient to fund reinvestment needs. However, opportunities to place capital for expansion are limited . Here we’ll go over how to make sure you’re calculating retained earnings properly, and show you some examples of retained earnings in action. Below is a short video explanation to help you understand the importance of retained earnings from an accounting perspective. A dividend is the distribution of some of a company’s earnings to a class of its shareholders, as determined by the company’s board of directors. All the other options retain the earnings for use within the business, and such investments and funding activities constitute the retained earnings .

How To Prepare A Statement Of Retained Earnings

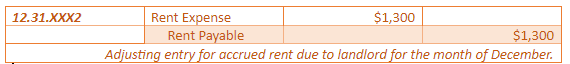

There are several methods for calculating depreciation, generally based on either the passage of time or the level of activity or use of the asset. Depreciation refers to the allocation of the cost of assets to periods in which the assets are used . Depreciation refers to the allocation of the cost of assets to periods in which the assets are used. There are periodic adjustments to the account that started at the time the business was initially formed.

Her expertise is in personal finance and investing, and real estate.

Explaining Retained Earnings Statement In Context

The next thing you’ll notice is that it’s a component of shareholders’ equity rather than an asset — which is counterintuitive considering it’s a big chunk of cash. While that’s true, it’s technically not the company’s cash; it belongs to the shareholders. How to Find Negative Retained Earnings in a 10-k – Does it Indicate Distress?

Retained earnings represent an incredibly beneficial link between the income statement and the balance sheet, as they are recorded under shareholders’ equity, which connects the two statements. This statement is used to reconcile the beginning and ending retained earnings for a specified period when it is adjusted with information such as net income and dividends.

Step 3: Add Net Income From The Income Statement

In above format, the heading part of the statement is somewhat similar to that of an income statement. The time span may be a quarter, a six month period or a complete accounting year of the entity. It increases when company earns net income and decreases when company incurs net loss or declares dividends during the period.

At some point in your business accounting processes, you may need to prepare a statement of retained earnings. Now, if you paid out dividends, subtract them and total the Statement of Retained Earnings.

Retained earnings show how the company has utilized its profit over a period of time which the company has reinvested in its business since its inception. Reinvestment may be in the form of purchase of assets or payment of any liability. However, it does not show the cash available after the payment of dividends. Creditors view this statement as well, as they want to look at several performance measures before they can issue credit to a company.

For more on financial statement audiences and purposes, see Materiality Concept. See the article Owners Equity, for more on the Equity role on financial statements. That’s particularly true because, given the choice between being paid a $1 dividend per share or having that share go up in price by $1, most investors would choose the latter for a multitude of tax reasons.

As a result, the retained earning’s amount carried forward to the balance sheet is also shown here. It is a very effective tool for various stakeholders in assessing the health of the company if used correctly. A balance sheet consists of assets, liabilities, and stockholder equity. This balance sheet ensures that the assets on the books of a company are equal to the sum of the company’s liabilities and stockholder equity.

Best Bookkeeping Services In Denver Are you looking for bookkeeping services Denver? Equity can be referred to as shareholder’s Equity and in private companies – owner’s equity…. Finally, it should be noted that they will provide a financial mechanism that will be crucial for a company to enjoy good health.

It is also interesting that there are several simple ratios we can use to compare our company to others to give us a better comparison of the effectiveness of a company using its funds to better the company. You can determine quite a lot about management, their plans for growth, and how shareholder-friendly they are. Interestingly, if you look at Berkshire Hathaway’s balance sheet, you see that for the last two years, they have run with percentages similar to Oshkosh Corps.

When you subtract net expenses from revenue, you get net income, which is a key part of the retained earnings calculation. Your retained earnings balance is $105,000, and you can decide if you want to reinvest that money and/or pay off debts with it. If you’re a new business, put in a $0 for retained earnings, and if your retained earnings were in the negative, make sure to mark that as well. You could have negative retained earnings if you have a net loss and negative or low previous retained earnings. The company will then expense a portion of original cost in equal increments over that period.

- You can determine quite a lot about management, their plans for growth, and how shareholder-friendly they are.

- The statement is the place to tell us how they plan to deploy the capital for growth, i.e., dividend payments, share repurchases, debt payments, etc.

- At some point in your business accounting processes, you may need to prepare a statement of retained earnings.

- Depreciation refers to the allocation of the cost of assets to periods in which the assets are used.

- A statement of retained earnings shows creditors that the firm has been prosperous enough to have money available to repay your debts.

The salvage value is an estimate of the value of the asset at the time it will be sold or disposed of. It also shows the dividend policy of the company, as it shows whether the company reinvest profits or has paid a dividend to its shareholders. Retained earnings are mainly analyzed for evaluating the profits and focusing on generating the highest return for the shareholders. Using the retained earnings, shareholders can find out how much equity they hold in the company. Dividing the retained earnings by the no. of outstanding shares can help a shareholder figure out how much a share is worth. The statement of retained earnings has great importance to investors, shareholders, and the Board of Directors. Many companies adopt a retained earning policy so investors know what they’re getting into.

Use our research library below to get actionable, first-hand advice. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. Alternatives Looking for a different set of features or lower price point? Check out these alternative options for popular software solutions. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you.

Sandhill Corp. normally sells investments of the type mentioned above. Additionally, there are laws stating that treasury stock purchases are limited to the amount of retained earnings. These laws ensure that companies do not take more income than they make in a year and give it to stockholders when they are not doing well financially. You must adjust your retained earnings account whenever you create a journal entry that raises or lowers a revenue or expense account.

Author: Ken Berry